deferred sales trust irs

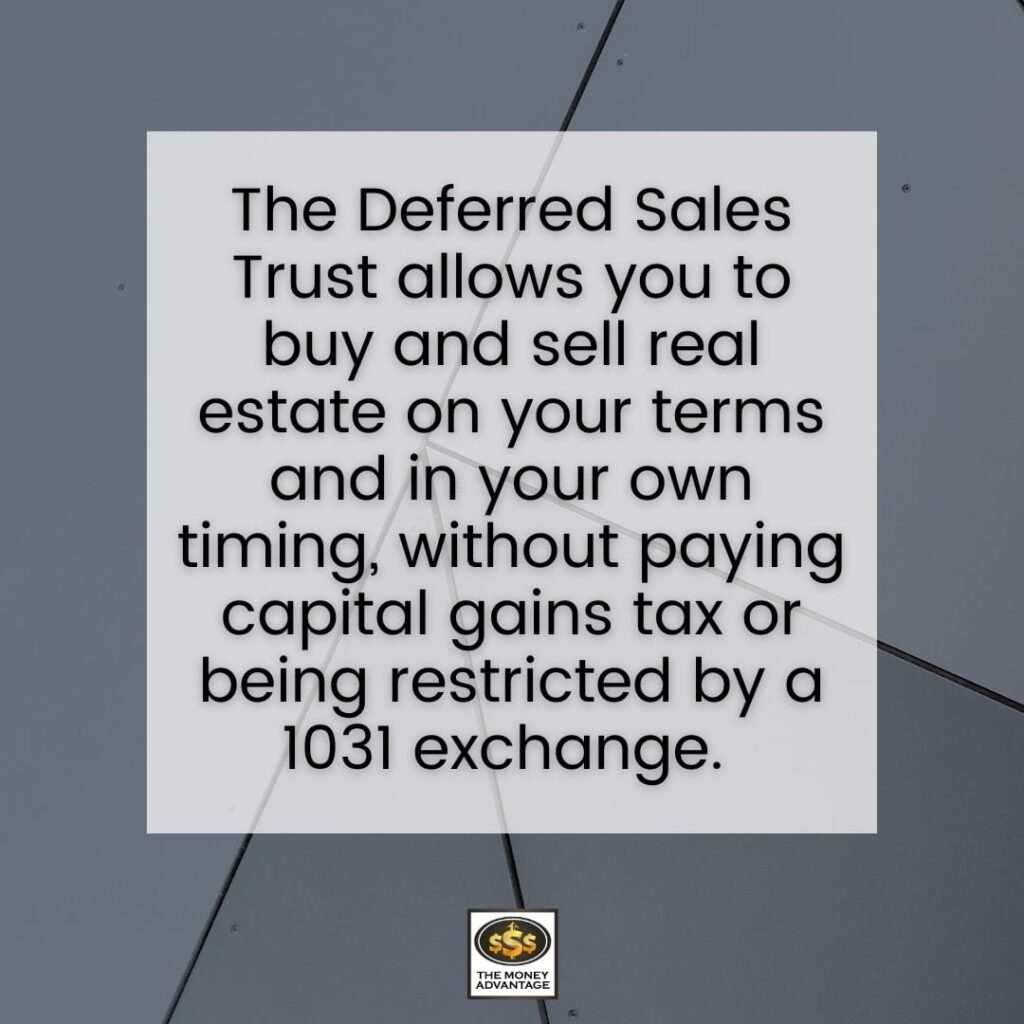

The deferred sales trust is a legal time-tested option to help business and real estate owners sell their assets and save on capital gains taxes. IRS validates the Deferred Sales Trust as a compliment to or alternative for a 1031 exchange as I mentioned earlier.

Deferred Sales Trust Capital Gains Tax Deferral

A Deferred Sales Trust TM is a viable financial strategy often used to defer capital gains taxes.

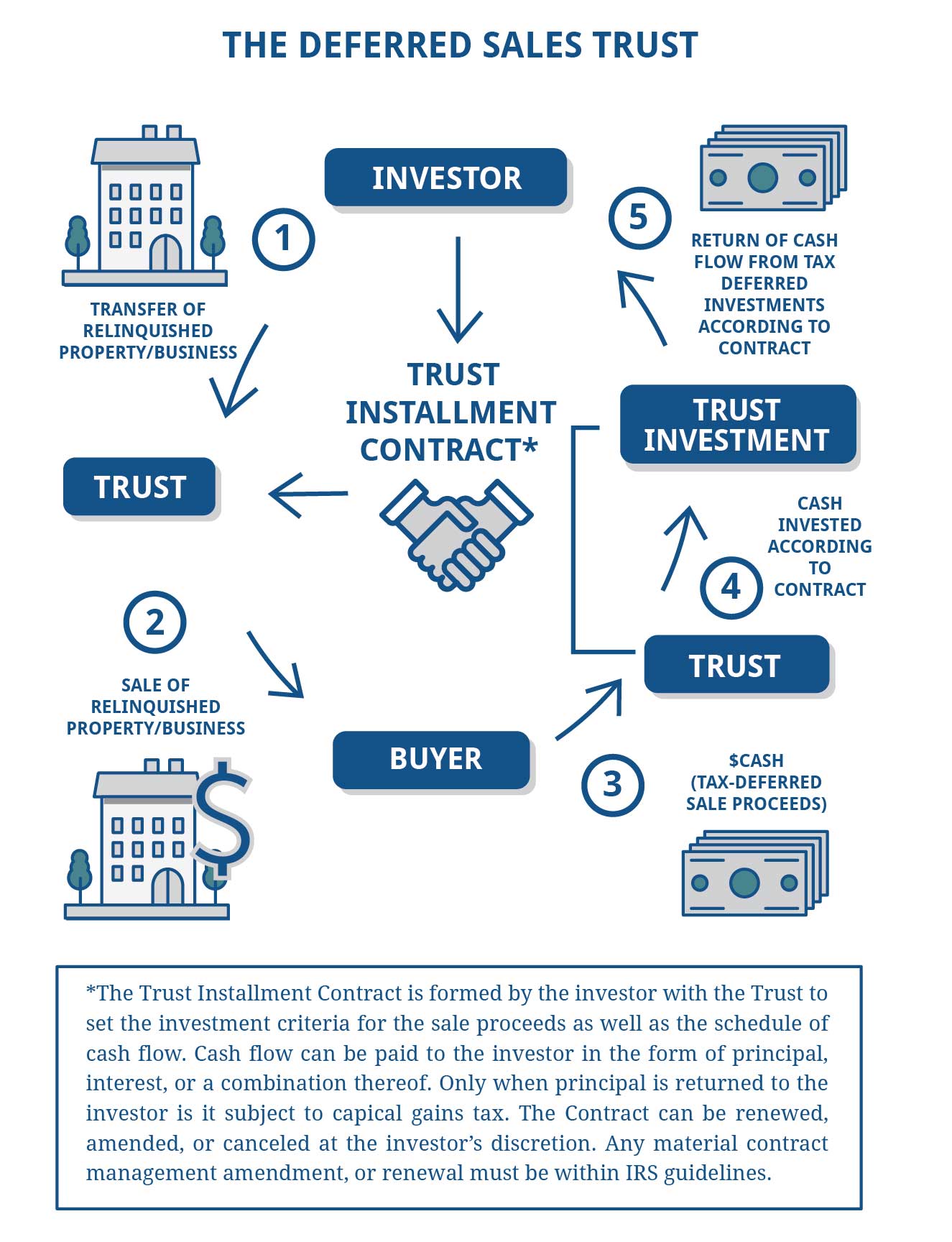

. What Is a Deferred Sales Trust. Unlike a 1031 exchange sellers have more investment options with a deferred. Under the Deferred Sales Trust investors are able to reinvest the sale proceeds of their investment assets into a trust and are only taxed upon the receival of the funds from the.

The Deferred Sales Trust or DST is sometimes used by people who want to sell a highly-appreciated asset but who may face significant capital gains taxes if they sell directly. We are experts and focused on helping make simple all things DST and how it. In order for a Deferred Sales Trust to qualify for capital gains tax deferral it must be considered a bona fide third- party trust with a legitimate third-party trustee.

Defer Capital Gains Tax. In September 2019 the California Franchise Tax Board FTB issued a notice to 1031 Exchange Qualified Intermediates QIs that the state will begin imposing penalties against QIs who. But I am more than sure there is no ruling on this issue.

Section 11031k-1e1 provides that a transfer of relinquished property in a deferred exchange will not fail to qualify for nonrecognition of gain or loss under 1031 merely because the. There are two situations where the gain all or part cannot be deferred. A deferred sales trust can be a useful tool for estate planning and portfolio diversification.

This classifies the DST as an installment sale which legally allows you to defer capital. If you require trust demonstrate what you. This strategy capitalizes on a tax loophole in the IRS code that allows you the selling party of.

1 if the character of the gain realized from the sale is treated as ordi nary income because of the depreciation. A deferred sales trust DST allows for the deferral of capital gains tax when selling real estate or other qualified assets. The Deferred Sales Trust is a third-party business trust and utilizes the installment sale treatment under the Internal Revenue Code IRC 453.

Rather than a typical transaction. Capital Gains Tax Solutions is an exclusive trustee for the Deferred Sales Trust. I am sure this.

A deferred sales trust The DST is a new alternative to the 1031 exchange that allows the taxpayer to defer the gain on a sale. The deferred sales trust is governed by IRC 453 of the Internal Revenue Code. Capital gains tax deferral.

Deferred Sales Trust Max Cap Financial

Deferred Sales Trust Defer Capital Gains Tax

8 Deferred Sales Trust Ideas Trust Capital Gains Tax Capital Gain

How Can I Offset Or Defer The Sale Of Capital Gains On A Business

Using The Deferred Sales Trust In Preserving Capital And Limiting Taxable Gains Credo

Deferred Sales Trust A Tax Plan Or A Product A Bit Of Both

Solving Capital Gains Tax With The Deferred Sales Trust Brett Swarts

Deferred Sales Trust Introduction Jrw Investments

What Are The Differences Between A Deferred Sales Trust Dst And A Charitable Remainder Trust Crt Reef Point Llc

Deferred Sales Trust The Other Dst

Deferred Sales Trust Capital Gains Deferral

Why You Should Consider Using The Deferred Sales Trust More Than Ever

![]()

Deferred Sales Trust Atlas 1031

Advanced Planning Deferred Sales Trusts The Quantum Group

Deferred Sales Trusts How Do They Work Cohan Pllc

Deferred Sales Trust A Tax Strategy For Investors Fortunebuilders

Deferred Sales Trust Introduction Jrw Investments

Why The Irs Allows Deferred Sales Trusts And How You Can Benefit Reef Point Llc